Latest Insights

Ruling is Part of a Negotiated 45-Day Temporary Restraining Order

Read More

Non-Carb Retail Results: 2022

Bottled Water Category Shines, While RTD Tea, Enhanced Waters Shed Volume

Read More

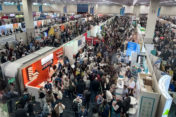

Expo West Fertile Ground for Next Growth Trends

Vying for Attention: Functional Mocktails, Seaweed, Upcycling, Canned Sports Drink, Hard Honey

Read More

Unilever-Owned Liquid I.V. Focused on $1B Brand Status

Powdered Beverage ‘Headroom is Unlimited,’ CEO Says. Brand Represents Possible Long-Term Disruption for RTD Sector.

Read More

U.S. Carbonated Soft Drinks Extract Value in 2022

CSD Pricing, Dollars Jump. Volume Posts Modest -1.9% Decline

Read More

Coke and Pepsi Bottlers Look Ahead: See Return to Single-Digit Pricing Increases

Little Increase in Retailer Pressure Over Pricing. Promotions Remain Strategic.

Read More

BodyArmor Looks to Double Awareness, Become Household Brand, CMO Says

March Brings Investment Growth for Coke’s Sports Drink Brands, He Says

Read More

BodyArmor Looks to Become Household Brand, CMO Says.

Exclusive Interview: BA Sports Nutrition CMO Matthew Dzamba

Read More

PepsiCo, Coke Executives Prepare for Possible Second-Half Challenges

Fewer Price Hikes Expected in 2023. Promotional Activity to Remain Highly Selective

Read More