Exclusive

Mobi Platform, Piloted With Reyes Coca-Cola, Now Broadly Available

Read More

Limited Diet Coke Test Replaces Aspartame With Plant-Based Sweeteners

Trial in Single Market Available Until July at Target, Select Retailers

Read More

Buffalo Rock Latest Pepsi Bottler Eyeing Alcohol Distribution

Hard Mtn Dew Enters Arizona, Kentucky as Three States Resist Blue Cloud

Read More

Speculation Ended: PepsiCo’s Blue Cloud Not Acquiring Corwin’s Beer Business

Plus, Blue Cloud Now Permitted by TTB in 40 States (Map)

Read More

BodyArmor Enters ‘Rapid Hydration’ Segment With Flash I.V.

Product Ships Regionally in May. National Launch in 2024

Read More

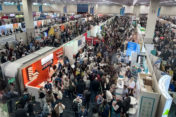

Expo West Fertile Ground for Next Growth Trends

Vying for Attention: Functional Mocktails, Seaweed, Upcycling, Canned Sports Drink, Hard Honey

Read More

Unilever-Owned Liquid I.V. Focused on $1B Brand Status

Powdered Beverage ‘Headroom is Unlimited,’ CEO Says. Brand Represents Possible Long-Term Disruption for RTD Sector.

Read More